operating cash flow ratio calculator

Once cash flow is determined the next step. The cash flow to debt ratio calculator is a tool that allows you to measure the companys cash flow from operations in relation to its total debt.

Llcr Loan Life Coverage Ratio Appforfinance

Step 1 Calculate Cash Flow from Operating Activities.

. Operating Cash Flow Ratio. But as it does not provide much detailed information to the investor companies use the indirect method of OCF. Enterprise Value Calculator Online.

The operating cash flows of a company YZ Ltd. Below is an operating cash flow ratio calculator which estimates how many times over a company could pay off current liabilities in a given period using only operating cash flows. Operating Cash Flow Ratio Operating Cash Flow Total Debts.

Calculating the OCF margin is a four-step process. Step 3 Divide Operating Cash Flow by Revenue. The operating cash flow ratio is a measurement that indicates whether the cash created from continuing operations is sufficient.

Now lets use our formula. Price-to-Operating-Cash-Flow explanation calculation historical. Operating Cash Flow Ratio Definition.

Traditional accounting ratios are often based on the net income of a business. From an investors point of. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

Tatneft PJSC FRATTFB Price-to-Operating-Cash-Flow as of today October 26 2022 is 138. Operating Cash Flow. How Does Operating Cash Flow Calculator Work.

Are 50000000 and the total debt. Net sales 5400000. OCF is equal to Total revenue minus.

Net income is a subjective measure which can be manipulated by accounting assumptions and. Operating ratios is the ratio which measures the efficiency of a firms management comparison with operating expense to net sale. Here is how the Operating.

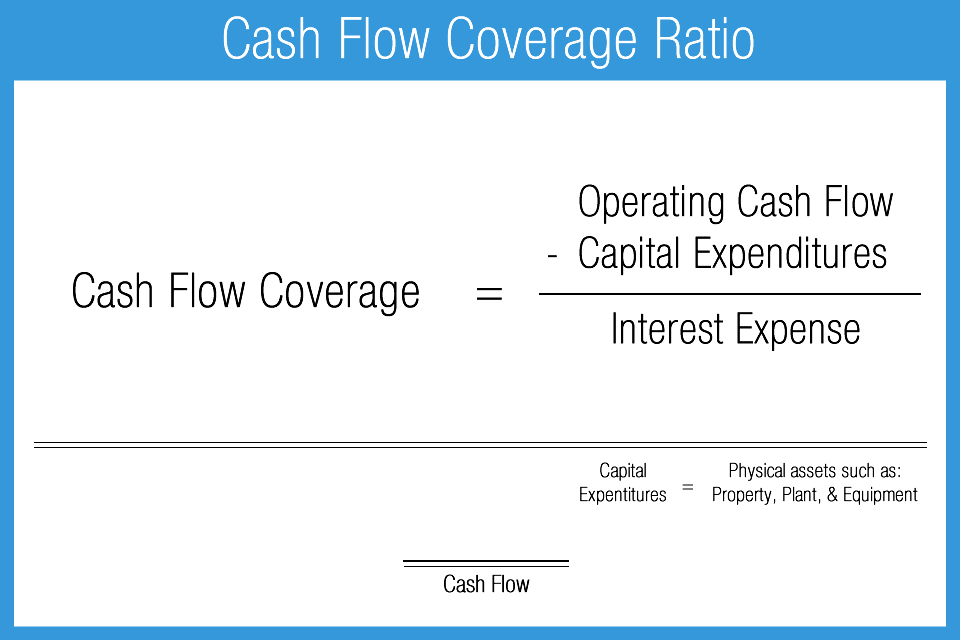

Let us try to understand the concept of cash flow coverage ratio with the help of an example. To calculate FCF locate the item cash flow from operations also referred to as operating cash or net cash from operating activities from the cash flow statement and. Step 2 Calculate Net Revenue.

We can calculate operating ratio. In this case we want Cash Flow from Operations or Free Cash Flow which is equal to operating cash flow minus capital expenditures. Operating Cash Flow Ratio.

We can apply the values to our variables and calculate Cash Flow to Sales. This method is very simple and accurate. To use this online calculator for Operating Cash Flow enter Earnings Before Interest and Taxes EBIT Depreciation D Taxes T and hit the calculate button.

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Now that we have all the data needed to calculate the operating cash flow margin we can substitute the values for the variables in the formula. Get Your 7-Day Free Trial.

Operating Cash Flow Margin.

Cash Flow Ratio Analysis Double Entry Bookkeeping

Cash Flow From Operating Activities Direct And Indirect Method Efm

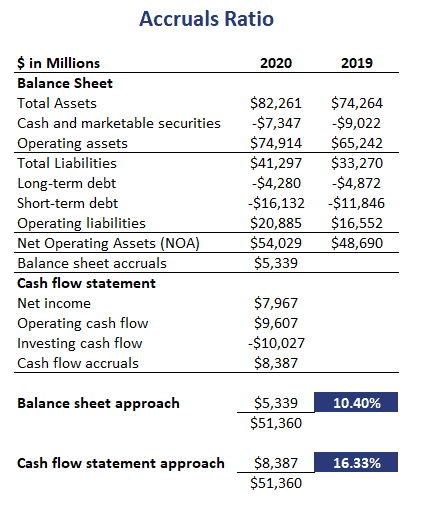

Accruals Ratio Excel Implementation

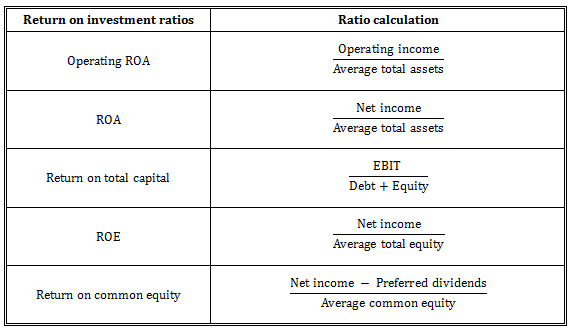

Cfa Level 1 Financial Ratios Sheet Analystprep Cfa Exams

Cash Flow Ratios Accounting Play

Analyzing Cash Flow Information

The 10 Cash Flow Ratios Every Investor Should Know

Cash Flow Indicator Ratios Calculator Get Free Excel Template

Cash Flow Indicator Ratios Calculator Get Free Excel Template

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Free Cash Flow And Why Is It Important Example And Formula Article

Net Cash Flow Formula Step By Step Calculation With Examples

The 6 Best Metrics And Financial Statements For Your Cash Flow Forecast

Cfads Cash Flow Available For Debt Service Mazars Financial Modelling

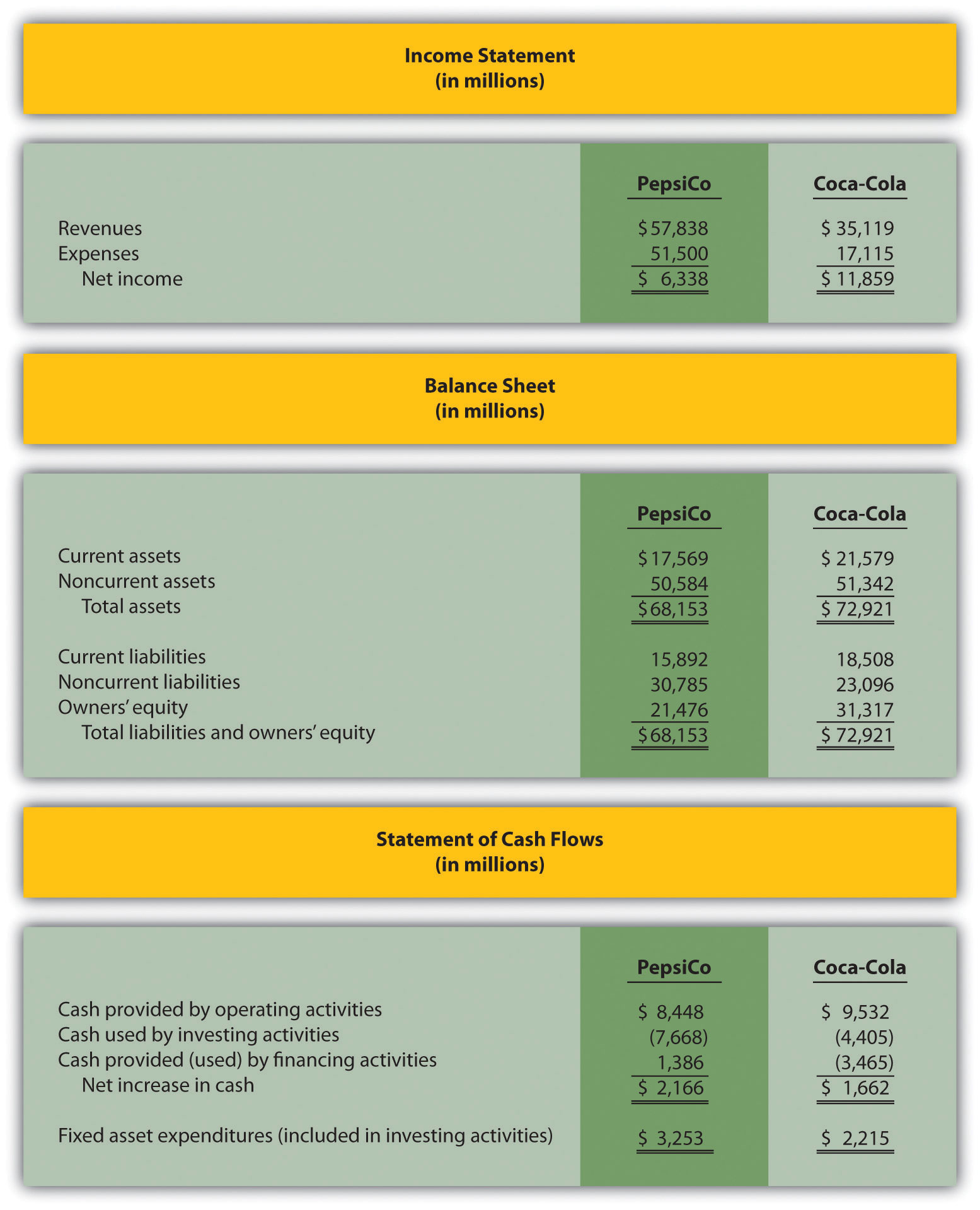

Financial Ratios Calculations Accountingcoach

Cash Flow From Operations Summary And Forum 12manage

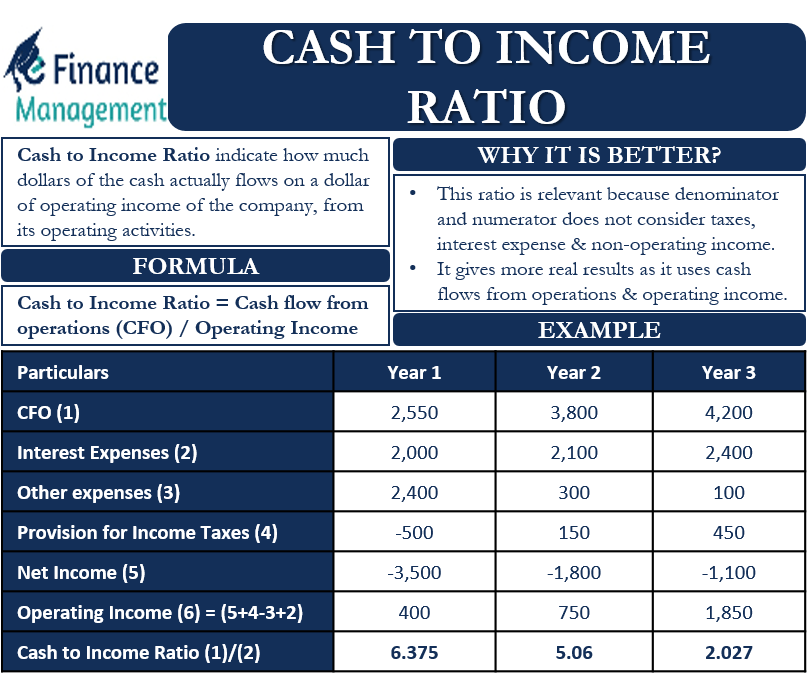

Cash To Income Ratio Meaning Formula Example And More